Management Policy

Corporate Governance

Basic views on corporate governance

The SBI Sumishin Net Bank (the "Company”) believe that enhancing vigorous management with quick and decisive decision making through sufficient and effective use of our management resources while ensuring transparency and fairness of the decision-making process is important for achieving sustainable growth and increasing enterprise value in the long-term. Therefore, we are committed to strengthening our corporate governance system in accordance with the following basic views:

-

Respect shareholder rights and secure equal treatment of shareholders.

-

Consider the interests of stakeholders including our shareholders, and appropriately cooperate with the stakeholders.

-

Appropriately disclose corporate information and ensure transparency.

-

Build a framework where independent outside directors play central roles (composition of the Board of Directors, establishment of the voluntary Nomination and Compensation Committee, etc.) to ensure effectiveness of supervisory function for performance of duties by the Board of Directors.

-

Engage in constructive dialogue with shareholders that have investment policies that match the medium- to long-term shareholder interest.

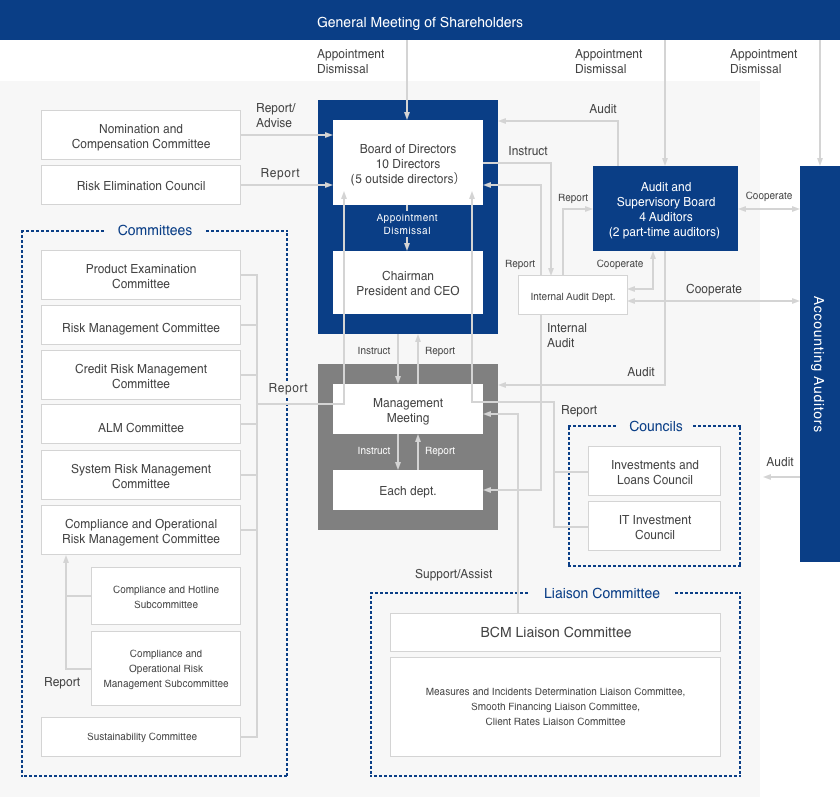

Overview of corporate governance framework and the reason for adopting the framework

The Company selected to formulate a company with a board of company auditors with the understanding that having the Audit and Supervisory Board Members conduct independent audit of the directors in addition to supervising the Board of Directors is effective for ensuring appropriate performance of duties by the directors.

To strengthen the checks and balances system by applying independent external perspectives under the company with a board of company auditors, all of the four Audit and Supervisory Board Members are outside auditors, of which two satisfy the independence standard. In addition, directors have one-year terms to ensure agile performance of management responsibilities towards shareholders. Three outside Directors that meet independence standard are appointed to further strengthen mutual oversight function among the Board of Directors.

The Company has also introduced executive officer system for faster decision making and efficient business execution.

We will continue to examine and discuss our organizational design, and consistently strengthen corporate governance.

Our corporate governance structure is shown in the diagram below.

Internal Control

Under appropriate company management, the Board of Directors decides the company-wide management policy; makes certain full compliance with laws and regulations, customer protection, and improvement of convenience to customers; and decides the basic policy for building internal control systems to develop and establish an appropriate management structure for various risks to ensure the soundness and appropriateness of business operations. For their effective function, the following organizations have been placed under the Board of Directors.

Board of Directors

- Chairperson

- Noriaki Maruyama (President and CEO)

- Structure

- Consisting of all directors, and the current members are stated in the table below. Our Board also includes Audit and Supervisory Board Members.

- Roles and Authorities

- In addition to execution of important business, the Board of Directors resolve important matters related to establishment of internal control systems, compliance, and risk management. The Board also receives reports on execution of duties from directors and executive officers, and supervises the execution of duties of the directors and executive officers, etc.

Audit and Supervisory Board

- Chairperson

- Fumihito Eno (Full-Time Outside Audit and Supervisory Board Member)

- Structure

- Consisting of all Audit and Supervisory Board Members, and the current members are stated in the table below.

- Roles and Authorities

- The Company has adopted an Audit and Supervisory Board Member System with each member performing audits from expert and multilateral perspectives. The Audit and Supervisory Board members receive reports on, discuss, or pass resolutions on important audit-related matters. The Audit and Supervisory Board members also meet regularly with the Representative Director to exchange opinions on issues to be addressed by the Company, the status of the environment for the members' audits, and important auditing issues, and to deepen mutual recognition.

Management Meeting

- Chairperson

- Noriaki Maruyama (President and CEO)

- Structure

- Consisting of the directors, executive officers, etc., appointed by the Board of Directors, and the members of the current are stated in the table below. Audit and Supervisory Board Members also attend as observers.

- Roles and Authorities

- As the decision-making body for individual and specific important matters related to business execution, the Management Meeting deliberates and determines issues including individual business strategies, sales measures, ALM, systems investment, and risk management. Its members are comprised of directors (excluding outside directors), and it aims to strengthen decision making and secure transparency by requiring constant participation by the full-time Audit and Supervisory Board Member(s).

Risk Elimination Council (Council for elimination of risks arising from parent business company, etc.)

- Chairperson

- Yasunaga Matsumoto (Chairman)

- Structure

- Consisting of directors (excluding outside directors) selected by the Board of Directors and an attorney. The current members are stated in the table below.

- Roles and Authorities

- Since the parent business company holds 34.1% of the issued and outstanding shares of the Company which engages in banking business, the committee has been established to secure independence from the parent business company and the parent business company group, etc., and to ensure full implementation of measures to eliminate business risks arising from the companies, etc. The Risk Elimination Council checks the independence of the Company and effectiveness of risk elimination measures, and reports to the Board of Directors at least semi-annually.

Composition of the Board of Directors, Audit and Supervisory Board, Management Meeting, Nomination and Compensation Committee, and Risk Elimination Council.

● Chairperson, 〇 Member

Scroll

| Name | Title | Board of Directors | Audit and Supervisory Board | Management Meeting | Risk Elimination Council | |

|---|---|---|---|---|---|---|

| Toshihiro Eto |

Representative Director and Chairman (part-time) |

〇 |

||||

| Yasunaga Matsumoto |

Representative Director and Chairman |

〇 |

〇 |

● |

||

| Noriaki Maruyama |

Representative Director, President and CEO |

● |

● |

〇 |

||

| Ryota Okazawa |

Director |

〇 |

〇 |

〇 |

||

| Tomoyuki Naomi |

Director |

〇 |

〇 |

|||

| Keiji Yamamoto |

Director |

〇 |

〇 |

|||

| Tsutomu Tahara |

Director (part-time) |

〇 |

||||

| Masayuki Okamoto |

Director (part-time) |

〇 |

||||

| Fumihito Eno |

Full-Time Audit and Supervisory Board Member |

(Attend) |

● |

(Attend) |

||

| Kei Morita |

Full-Time Audit and Supervisory Board Member |

(Attend) |

〇 |

(Attend) |

||

| Mariko Hidaka |

Audit and Supervisory Board Member (part-time) |

(Attend) |

〇 |

|||

| Naoyuki Iwashita |

Audit and Supervisory Board Member (part-time) |

(Attend) |

〇 |

Internal Audit

The company has established an internal audit department that operates independently from the business execution departments to verify the effectiveness and appropriateness of internal controls. The Board of Directors recognizes that internal audits are essential for achieving management objectives, ensuring compliance with laws and regulations, protecting customers, and managing risks, and is working to establish an appropriate internal audit system.

Internal audits are conducted based on risk assessments and cover all operations, departments, and systems, including outsourced operations and affiliated companies. Internal audits follow the auditing methods based on the international standards of the Institute of Internal Auditors (IIA) to verify the appropriateness and effectiveness of internal control systems. Based on these audits, recommendations, guidance, advice, and proposals are provided. The audit results are reported to the responsible officers, auditors, and the Board of Directors, and shared with relevant departments as necessary. Additionally, regular exchanges of opinions with accounting auditors are conducted to ensure the effectiveness of the audits.

Name of the Accounting Auditor

The Company has concluded an audit contract with KPMG AZSA LLC to serve as our accounting auditor and undergoes accounting audits.

Please refer to the file below for the status of corporate governance of the Company including compliance with the Corporate Governance Code.