Sustainability

Compliance

Compliance

Basic Policy

To fulfill our social responsibilities and public mission, the SBI Sumishin Net Bank Group has identified compliance as a key management priority. At our Group, we are committed to upholding and promoting compliance, not only by adhering to laws and regulations but also by aligning with broader social norms to earn the trust of our customers and society.

Anti-Bribery and Corruption Policy

Compliance System

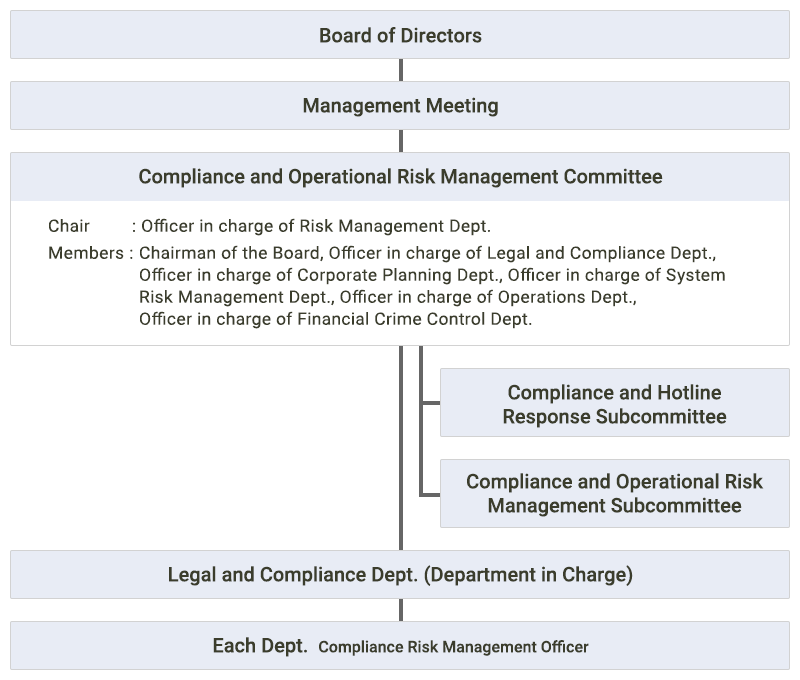

The Legal & Compliance Department, as the department with oversight, formulates and manages the annual practical plan (below “Compliance Program”) for the development and promotion of our company-wide compliance system, develops related regulations, and implements various measures such as training. In addition, with regard to compliance risk management, including the prevention of corruption in all its forms, our risk management policy stipulates that the status of risk should be accurately ascertained through a series of activities including risk identification, assessment, administration, monitoring, control and reduction, and that the necessary measures should be taken against risk.

The Compliance Program is approved by the Board of Directors, with progress and achievements reported to the Board on a quarterly basis. If needed, the policies and content of the program are reviewed under the supervision of the Board of Directors.

Additionally, the Compliance and Operational Risk Management Committee reviews issues such as Compliance System, implementation status, and operational challenges, and reports their findings and responses to the Board of Directors as needed. The Legal and Compliance Department also provides quarterly reports on compliance status to the Board of Directors. The Board of Directors and others reflect these reports in management policies. We have established a system that enables the Board of Directors to conduct appropriate supervision.

≪ Compliance System Chart≫

Internal Reporting System (Compliance Hotline)

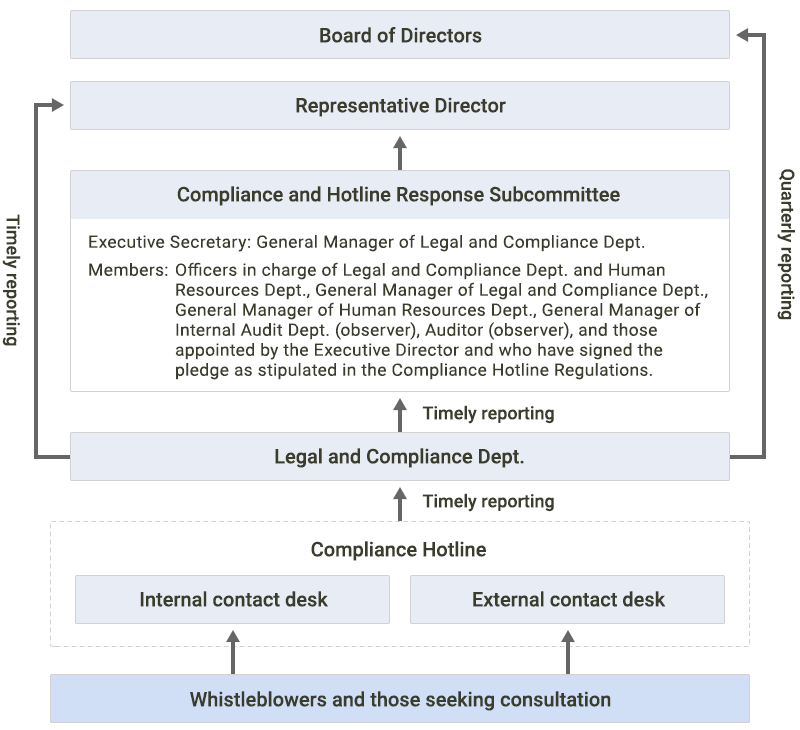

In order to respond promptly, fairly, and appropriately to the occurrence of compliance violations (including all forms of corruption such as bribery, insider trading, etc.), SBI Sumishin Net Bank has established, in addition to the reporting system based on job titles, a reporting system (below “Compliance Hotline System”) for officers, employees, and former officers and employees, as stipulated in the Compliance Hotline Regulations, to report, including anonymously, to both the internal contact desk and the external contact desk.

The Compliance Hotline Regulations stipulate that any information that could lead to the identification of whistleblowers or individuals who cooperate with verification and investigation (below “investigation collaborators”) must be strictly managed. Information that could identify whistleblowers or investigation collaborators must not be disclosed or leaked to third parties without the consent of the individuals concerned. It also prohibits any form of harassment, retaliation, or punitive actions against whistleblowers or investigation collaborators for their reporting or cooperation.

Furthermore, the regulations emphasize that there must be no attempts to identify whistleblowers or investigation collaborators, their privacy must be respected, and it must not be infringed upon. Confidential information obtained through the reporting process must not be disclosed or leaked to third parties, except for legitimate reasons necessary for the administration of the Compliance Hotline System.

≪ Reporting Route≫

Response to Compliance Violations

When officers and employees have compliance-related questions or become aware of actions that are or may be in violation of compliance, they must promptly consult with or report to their department manager or the compliance department. In addition, you can also report any concerns using the Compliance Hotline System. When a report is made under the Compliance Hotline System, the contact desk will report it to the Compliance and Hotline Response Subcommittee in a timely manner.

Following deliberations by the Compliance and Hotline Response Subcommittee regarding each reported incident, all reports will be checked and investigated, with the exception of those that are deemed to be impossible to investigate or unnecessary, while protecting the whistleblower and investigation collaborators.

When the results of an investigation reveal clear cases of compliance violations, prompt corrective and preventive measures will be taken, and the violators will be dealt with strictly in accordance with internal regulations. The secretariat of this system will compile the status of implementation of the Compliance Hotline System on a quarterly basis and report to the Board of Directors, while taking into consideration the appropriate execution of operations and the privacy of all concerned parties in the case in question.

Making All Employees Aware

-

Formulation of “Compliance Code of Conduct”

Together with our compliance policy and anti-bribery and corruption policy, we have formulated specific codes of conduct to be followed in the course of our operations as “Compliance Code of Conduct,” and we ensure that all officers and employees are aware of them.

-

Compliance Program

We formulate the Compliance Program annually, dedicating Bank-wide efforts to its steady implementation of compliance by taking action in response to law amendments, holding in-house training to include anti-corruption, such as the taking of bribes, and developing regulations.

Response to Antisocial Forces

SBI Sumishin Net Bank has established a basic policy against antisocial forces, and all of our officers and employees are working to ensure appropriate and safe conduct of our operations by complying with this policy.

Efforts to Prevent Money Laundering and Violations of Economic Sanctions

We have positioned the prevention of money laundering, the financing of terrorism and proliferation, and violations of economic sanctions as one of our most important management issues, and we are making Bank-wide efforts based on our “Policy on Compliance with Laws and Regulations for the Prevention of Money Laundering, etc., and Violations of Economic Sanctions.”