Governance

Tax Transparency

Basic Stance toward Tax

The SBI Sumishin Net Bank Group (the “Group”) has properly been fulfilling the obligations to file tax returns, pay taxes, and make reports to the tax authorities of each of the relevant countries and regions while complying with the tax-related laws, rules, and treaties there. In addition, continued payment of proper taxes to fulfill social responsibilities in the long term will lead us to achieving an important role for the economic and social development of each of such countries and regions. The Group has therefore established a tax policy to enhance our tax compliance framework and is determined to continue to appropriately fulfill the obligations for tax return filing, tax payments, and reporting to the relevant tax authorities in accordance with the tax policy.

The tax policy, established upon resolution by the board of directors and reporting to the audit and supervisory board, has been operated with a director in charge as the responsible person.

Tax Policy

In accordance with its rules on group compliance, the Group aims to enhance its corporate value by conducting appropriate tax cost management within an appropriate tax compliance framework while ensuring compliance with tax laws and regulations based on commonly applicable principles of compliance.

The Group is committed to understanding tax laws and regulations of the relevant countries and regions where the Group does business, as well as tax guidelines published by international institutions etc. Equally, The Group is committed to effecting timely and appropriate tax compliance in the jurisdictions where the Group does business.

In addition, the Group strives not to support and be involved in any transactions or activities whereby its customers unduly avoid tax burden or their obligations for filing tax returns.

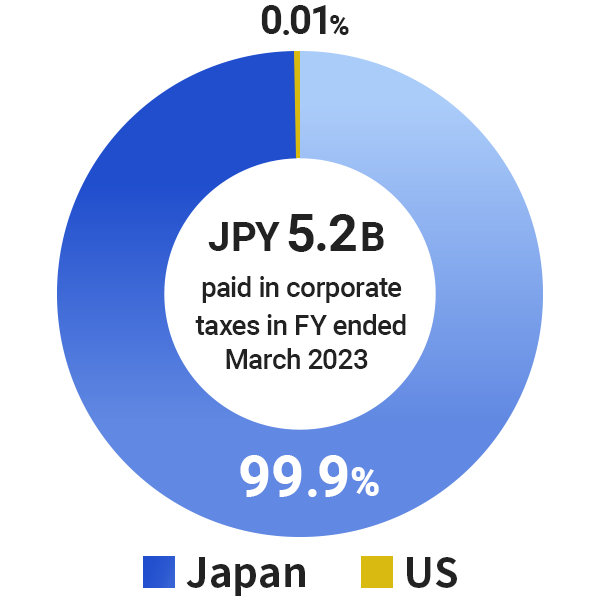

The Amount of Taxes Paid

The Group has paid the corporate taxes as shown below, in accordance with the Group's Tax Policy.